InfoWARE Analyst Daily Market Report (27-Dec-2024 15:10:21.950) | InfoWARE Finance

InfoWARE Analyst Daily Market Report (27-Dec-2024 15:10:21.950)

(Source: InfoWARE Terminal, Date: 27-Dec-2024)

Dear Investor,

InfoWARE Analyst Daily Market Report - 27-Dec-2024 15:10:21.949

The Nigerian equities market recorded another down day, as the NGX All-Share Index (NGXASI) closed the day down by -0.05%,

to bring the Year-to-Date returns up 34.40%.

The All Share Index closed at 102,133.30 against the previous close of 102,186.03, volume traded increased by 10.94% from 390.50M to 433.21M, while market turnover (the total value of shares traded) increased by 92.43% from NGN6.72B to NGN12.92B in 11,875.00 deals.

Market breadth (1.78x) signified Fifty-seven (57) advancers, as against Thirty-two (32) decliners.

Volume was up for 104 companies and down for 57

|

Top ASI Gainers Over Last 5 Trading Days

|

Top ASI Losers Over Last 5 Trading Days

|

For more detailed analysis, on InfoWARE Market Data Terminal <NSEPERF> <GO>

On InfoWARE Finance Mobile App (Android, iPhone & iPad, Windows Phone and Windows 8/10), "Top Gainers & Losers"

VETIVA S & P NIGERIA SOVEREIGN BOND ETF (VSPBONDETF) topped the advancers list closing at N290.00 with a gain of 45.00% followed by WAPIC INSURANCE PLC (WAPIC) which closed at N1.87 with a gain of 10.00%.

On the flip side HONEYWELL FLOUR MILL PLC (HONYFLOUR) and MERISTEM VALUE EXCHANGE TRADED FUND (MERVALUE) topped the decliners log with a loss of -9.09% at a close of N6.30, and -8.64% to close the day at N185.00 respectively.

| Symbol | LClose | %Chg |

|---|---|---|

| VSPBONDETF | 290.00 | 45.00 |

| WAPIC | 1.87 | 10.00 |

| UNIVINSURE | 0.55 | 10.00 |

| UPL | 3.85 | 10.00 |

| LOTUSHAL15 | 25.20 | 10.00 |

For more detailed analysis,

- On InfoWARE Market Data Terminal <TOPG> <GO>

- On InfoWARE Finance Mobile App ( Android, iPhone & iPad and Windows 10) , "Top Gainers & Losers"

Currency Market

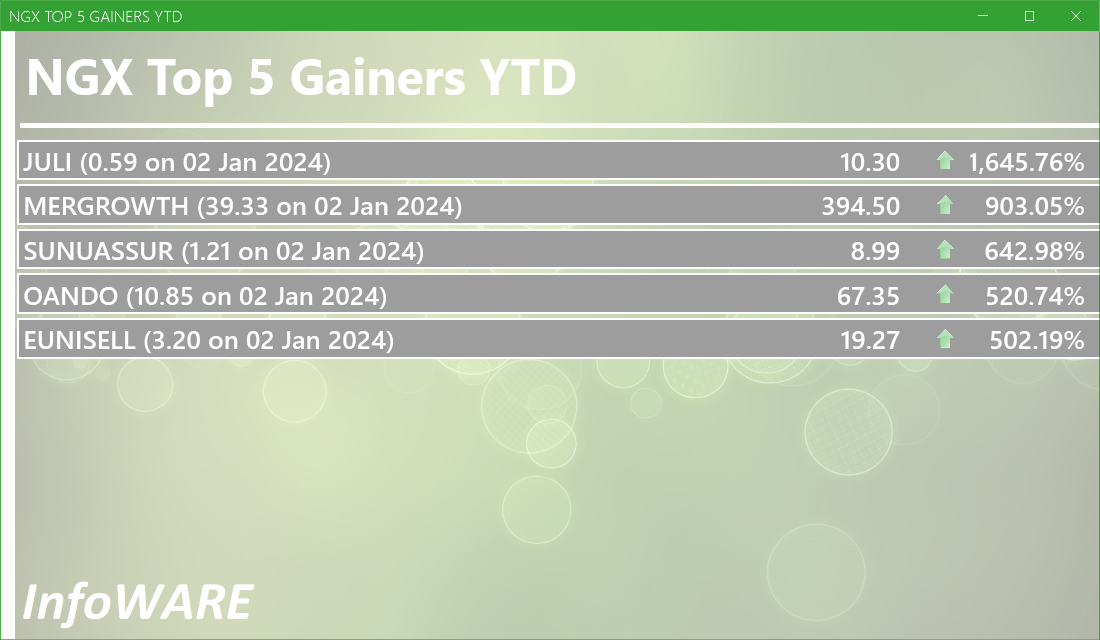

In the currency market, the Naira fell 0.10%(-1.50) against the Dollar to settle at 1 to 1Investment Insights - Top 5 Gainers YTD

These stocks are the best performers whose price has risen faster than the market as a whole with the best returns year to date. Momentum investors believe that stocks that have outperformed the market will often continue to do so because the factors that caused them to outperform will not suddenly disappear. In addition, other investors seeking to benefit from the stock’s outperformance will often purchase the stock, further bidding its price higher and pushing the stock higher still

For more detailed analysis,

- On InfoWARE Market Data Terminal <T5YTD2> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Research"

NSE: Bull Signal - Price crossed above 15 Day MA

This signal implies these stocks are under buying pressure and the price might continue to rise and therefore positions should be monitored closely. Further suggested analysis include looking at the overall market (ASI) to see if the uptrend is market wide, sector wide or specific to the stock. Portfolio managers tend to use this as a signal to do more research to add to their positions or lock in some profits. Typically further analysis should be done using commands like PC and RV on the InfoWARE Market Data Terminal. Another command is ALERTS to set price triggers for possible exit or entry as necessary

For more detailed analysis,

- On InfoWARE Market Data Terminal <NSEPERF> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Top Gainers & Losers"

| Symbol | Price | %Chg | 15DMA | PE | EPS | DivY | MktCap | Vol | Trades | Value | LstTradeTime |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VSPBONDETF | 290.00 | 31.03 | 210.09 | 0.00 | 0.00 | 576.00 | 7.00 | 152.86K | 27-Dec-2024 14:31:22.240 | ||

| JOHNHOLT | 7.09 | 9.03 | 7.01 | 8.80 | 0.91 | 1.25 | 2.76B | 193.77K | 19.00 | 1.36M | 27-Dec-2024 14:30:42.143 |

| MULTIVERSE | 6.10 | 9.02 | 5.58 | 0.00 | 0.00 | 0.85 | 2.60B | 982.55K | 37.00 | 5.96M | 27-Dec-2024 14:30:42.853 |

| FGSUK2025S2 | 100.00 | 8.98 | 95.94 | 0.00 | 0.00 | 8.00K | 2.00 | 8.00M | 27-Dec-2024 14:30:55.943 | ||

| NSLTECH | 0.63 | 7.94 | 0.60 | 0.00 | 0.00 | 15.87 | 3.55B | 563.08K | 28.00 | 345.65K | 27-Dec-2024 14:30:43.907 |

| FIDSON | 15.00 | 6.67 | 14.62 | 22.54 | 0.64 | 4.14 | 34.42B | 1.31M | 75.00 | 19.45M | 27-Dec-2024 14:30:40.820 |

| STANBICETF30 | 410.00 | 5.37 | 401.93 | 0.00 | 0.00 | 958.00 | 4.00 | 402.08K | 27-Dec-2024 14:31:21.993 | ||

| OMATEK | 0.68 | 4.41 | 0.66 | 6.82 | 0.10 | 0.00 | 2.00B | 1.96M | 26.00 | 1.32M | 27-Dec-2024 14:30:44.383 |

| CUTIX | 2.40 | 4.17 | 2.32 | 8.81 | 0.26 | 6.52 | 8.45B | 8.96M | 98.00 | 20.75M | 27-Dec-2024 14:30:39.987 |

NSE: BEAR Signal - Price crossed below 15 Day MA

This signal implies these stocks are under selling pressure and the price might continue to slide and therefore positions should be monitored closely. Further suggested analysis include looking at the overall market (ASI) to see if the downtrend is market wide, sector wide or specific to the stock. If the overal market trend is upwards, then since these stocks are heading in the opposite direction, then further analysis should be done using commands like PC and RV on the InfoWARE Market Data Terminal. Another command is ALERTS to set price triggers for possible exit is necessar

For more detailed analysis,

- On InfoWARE Market Data Terminal <BEARM> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10)

| Symbol | Price | %Chg | 15DMA | PE | EPS | DivY | MktCap | Vol | Trades | Value | LstTradeTime |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACCESSCORP | 24.00 | -2.92 | 24.19 | 8.56 | 2.81 | 1.87 | 853.09B | 35.44M | 857.00 | 871.32M | 27-Dec-2024 14:31:26.270 |

| MERVALUE | 185.00 | -9.46 | 194.03 | 0.00 | 0.00 | 417.00 | 5.00 | 78.63K | 27-Dec-2024 14:31:21.940 |

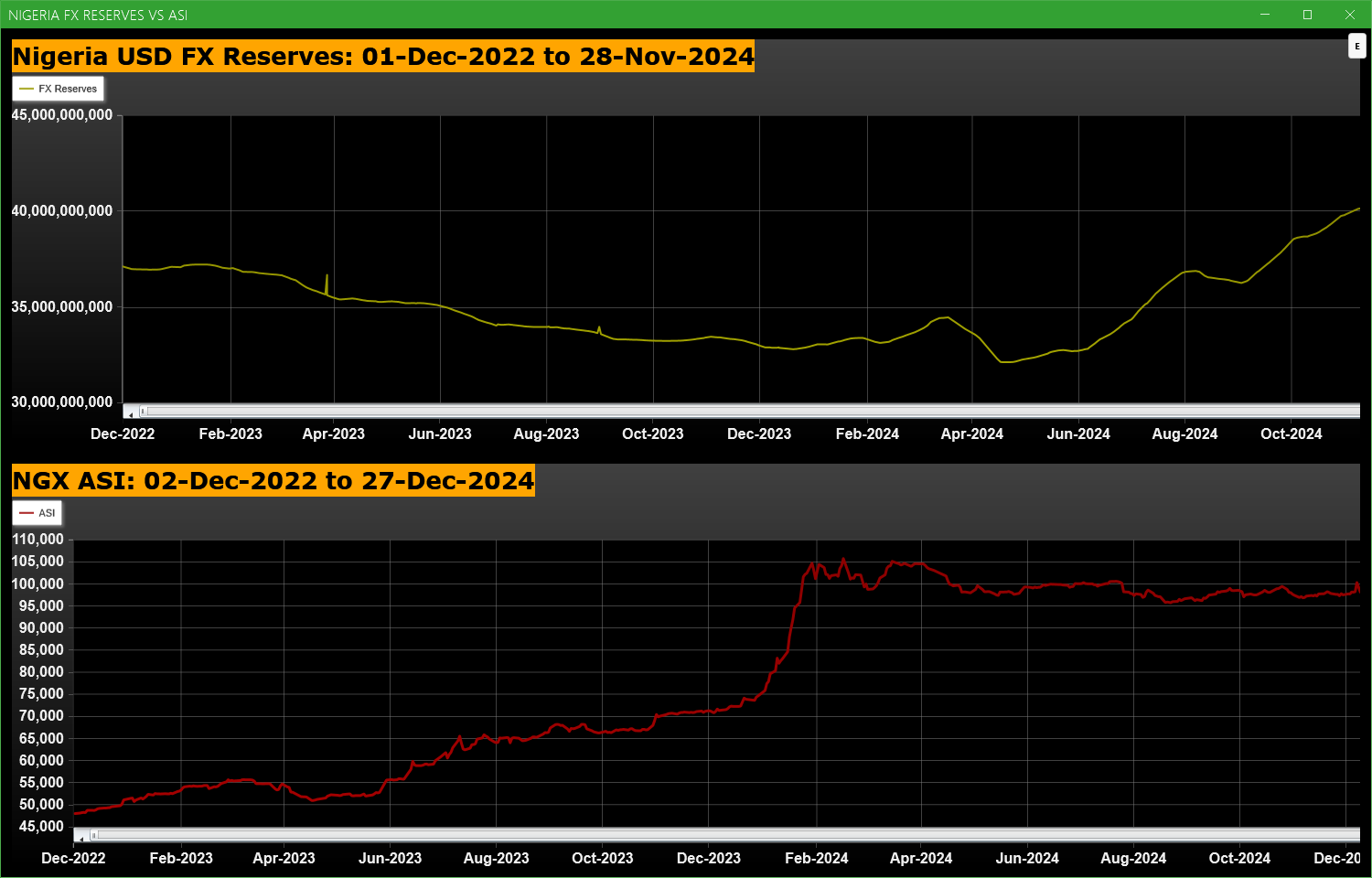

Economic Indicators - Nigeria FX Reserves Vs ASI Chart

Nigeria FX Reserves are assets held on reserve by CBN in foreign currencies. These reserves are used to back liabilities and influence monetary policy. Given the nature of the Nigeria economy, FX Reserves can appear to have an outsize influence on the economy and hence on the capital market. The chart below allows comparison of FX Reserves against the ASI to make investment decisions

For more detailed analysis,

- On InfoWARE Market Data Terminal <CI> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Research"

Market Trend - ASI (NGX All-Share-Index) With 50 & 200 Day MAvgs Chart

Technical traders typically use the 50 & 200 day moving averages to aid in choosing

where to enter or exit a position, which then causes these levels to act as strong

support or resistance. As a general guideline, if the price is above a moving average,

the trend is up. If the price is below a moving average, the trend is down.

It is important to note that critics of technical analysis say that moving averages act

as support and resistance because so many traders use these indicators to inform their

trading decisions. Also moving averages tend to work quite well in strong trending conditions

but poorly in choppy or ranging conditions.

Trading Strategies: Crossovers

Crossovers are one of the main moving average strategies. The first type is a price crossover,

which is when the price crosses above or below a moving average to signal a potential change

in trend. Another strategy is to apply two moving averages to a chart: one longer and one

shorter. When the shorter-term MA crosses above the longer-term MA, it is a buy signal, as

it indicates that the trend is shifting up. This is known as a golden cross. Meanwhile, when

the shorter-term MA crosses below the longer-term MA, it is a sell signal, as it indicates that

the trend is shifting down. This is known as a dead/death cross

For more detailed analysis,

- On InfoWARE Market Data Terminal <CI> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Research"

Unusual Volume: Volume traded is more than double the 90 day moving average (All exchanges; ASI & ASem). For more detailed analysis,

- On InfoWARE Market Data Terminal <UV> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10)

| Symbol | Name | Volume | 90DAvgVol | %VolChg | Price | LClose | %Chg | Trades | Value |

|---|---|---|---|---|---|---|---|---|---|

| NB | NIGERIAN BREW. PLC. | 8.63M | 3.08M | 180.11 | 32.50 | 32.50 | 0.00 | 118 | 280.51M |

| MANSARD | MANSARD INSURANCE PLC | 7.55M | 3.70M | 104.11 | 8.50 | 8.60 | -1.16 | 150 | 63.96M |

| NPFMCRFBK | NPF MICROFINANCE BANK PLC | 6.48M | 2.02M | 220.79 | 1.63 | 1.60 | 1.88 | 45 | 10.40M |

| HONYFLOUR | HONEYWELL FLOUR MILL PLC | 6.02M | 2.70M | 122.91 | 6.30 | 6.93 | -9.09 | 251 | 39.74M |

| INTBREW | INTERNATIONAL BREWERIES PLC. | 5.99M | 1.68M | 256.84 | 5.55 | 5.55 | 0.00 | 81 | 31.99M |

Investment Insights - High Div. Stocks

Dividend stocks distribute a portion of the company earnings to investors on a regular basis and they can a great choice for investors looking for regular income. As an investment or trading strategy, high dividend yield equities provide annual cash payments as against mostly capital gains in the price of a stock. The list in the table below represent the highest dividend paying stocks from the list of the most liquid stocks in the NSE top 30.

For more detailed analysis,

- On InfoWARE Market Data Terminal <HYIELD> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Research"

Investment Insights - Stocks outperforming the ASI but with approximately the same risk

These list of stocks represent equities that are less risky than the ASI but doing better than the ASI (All Shares Index) using the YTD (Year to Date) returns as the measure. The risk is measured by Beta. Beta is an assessment of a stock's tendency to undergo price changes, (its volatility), as well as its potential returns compared to the ASI. It is expressed as a ratio, where a score of 1 represents performance comparable to the ASI, and returns above or below the market may receive scores greater or lower than 1.

For a full list of both positively and negatively corelated stocks visit InfoWARE Market Data Terminal

- On InfoWARE Market Data Terminal <BANL> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10)

| Symbol | DivYield | PE | EPS | Beta | %ChgYTD | ASIYTDReturn | BetaDiff |

|---|---|---|---|---|---|---|---|

| HONYFLOUR | 1.40 | 16.28 | 0.31 | 0.99 | 89.76 | 34.40 | 0.01 |

| CONHALLPLC | 2.08 | 69.63 | 0.03 | 0.96 | 115.04 | 34.40 | 0.04 |

| ROYALEX | 7.81 | 0.00 | 0.00 | 0.96 | 37.88 | 34.40 | 0.04 |

| CORNERST | 5.28 | 8.62 | 0.35 | 0.93 | 118.00 | 34.40 | 0.07 |

| FIDELITYBK | 5.48 | 13.24 | 1.17 | 0.89 | 50.44 | 34.40 | 0.11 |

| DEAPCAP | 13.76 | 188.84 | 0.01 | 0.89 | 84.13 | 34.40 | 0.11 |

| VERITASKAP | 4.17 | 48.77 | 0.02 | 0.88 | 300.00 | 34.40 | 0.12 |

| UNIVINSURE | 0.00 | 0.00 | 0.00 | 0.83 | 111.54 | 34.40 | 0.17 |

| FLOURMILL | 2.21 | 83.52 | 0.98 | 0.79 | 147.13 | 34.40 | 0.21 |

| MAYBAKER | 3.75 | 58.94 | 0.14 | 0.78 | 79.05 | 34.40 | 0.22 |

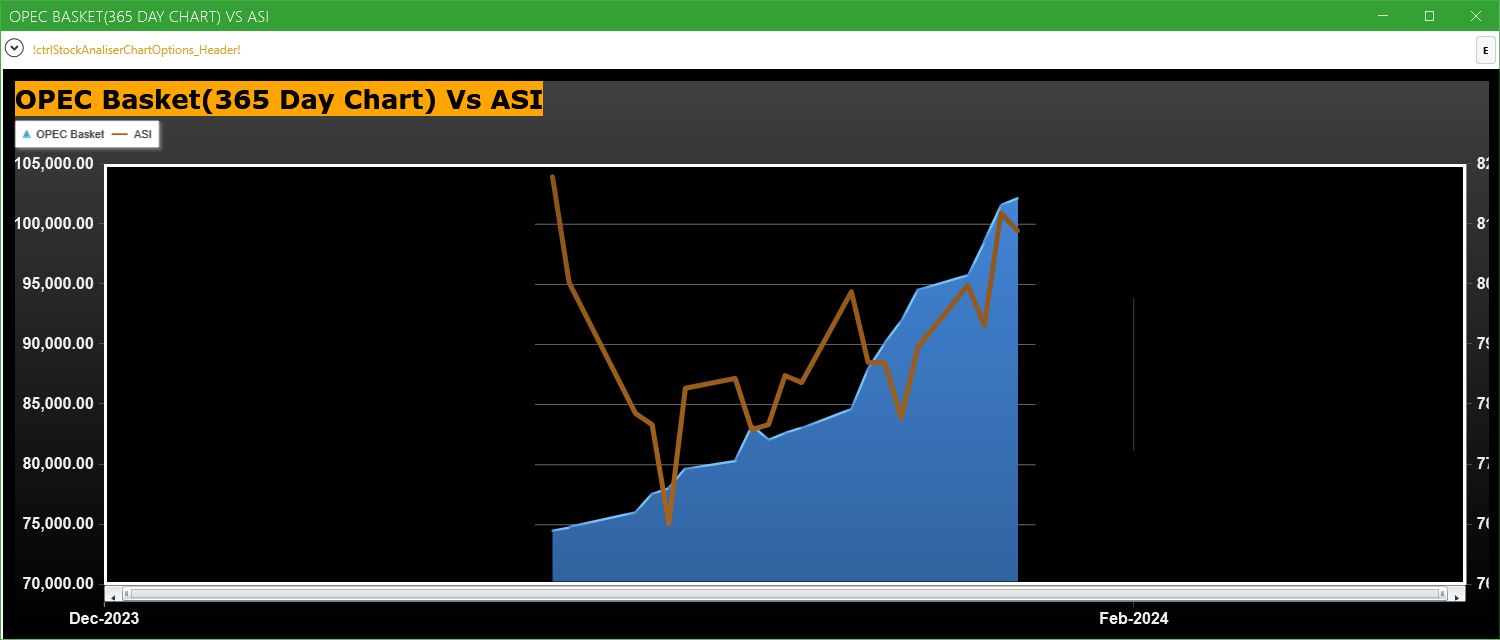

Chart of the day: OPEC Basket Price Vs ASI (365 Day Chart)

The OPEC basket is a weighted average of oil prices from the different OPEC members around the world. The basket is a benchmark, or reference point, for those monitoring the price of oil and the stability of the global oil market. Today, the OPEC basket averages the prices from Algeria, Angola, Ecuador, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates, and Venezuela. These fourteen countries represent the membership of OPEC. Many other countries throughout the world also produce oil. However, they are not OPEC members. Russia, the U.S., China, and Canada are all major oil producers but not OPEC members. OPEC?s member countries produce in total 40 percent of the world?s oil. (Definition Source: Investopedia.com)

For a full list of both positively and negatively corelated stocks visit InfoWARE Market Data Terminal

- On InfoWARE Market Data Terminal <BANL> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10)

For more detailed analysis,

- On InfoWARE Market Data Terminal <OVA> <GO>

- On InfoWARE Finance Mobile App ( Android , iPhone & iPad and Windows 10) , "Research"

African Markets

| Name | LClose | Change | %Chg |

|---|---|---|---|

| BRVM Stock Exchange | 273.27 | -2.01 | -0.73 |

| Botswana Stock Exchange | 10,049.11 | 0.00 | 0.00 |

| Egyptian Exchange | 29,973.15 | -144.57 | -0.48 |

| Ghana Stock Exchange | 4,888.53 | 34.46 | 0.71 |

| Johannesburg Stock Exchange | 84,935.27 | 220.26 | 0.26 |

| Lusaka Stock Exchange | 15,445.01 | -101.05 | -0.65 |

| Malawi Stock Exchange | 170,011.17 | -409.01 | -0.24 |

| Nigeria Stock Exchange | 102,186.03 | 831.11 | 0.82 |

| Nairobi Securities Exchange | 121.77 | -0.22 | -0.18 |

| Namibian Stock Exchange | 1,812.06 | 9.19 | 0.51 |

| Rwanda Stock Exchange | 148.84 | 0.24 | 0.16 |

| Uganda Securities Exchange | 1,166.58 | 1.86 | 0.16 |

Nigeria Market Indexes

| Symbol | LClose | %Chg | WTD% | MTD% | QTD% | YTD% | MktCap | Trades |

|---|---|---|---|---|---|---|---|---|

| ASI | 102,133.30 | -0.05 | 0.77 | 4.50 | 3.97 | 34.40 | 11,875 | |

| NGX30 | 3,777.42 | -0.16 | 0.63 | 2.81 | 3.55 | 33.06 | 6,312 | |

| NGXAFRBVI | 2,490.46 | -1.84 | -1.48 | 4.69 | 21.16 | 21.15 | 2,498 | |

| NGXAFRHDYI | 16,632.63 | 0.12 | 0.89 | 12.10 | 22.44 | 124.95 | 2,225 | |

| NGXASEM | 1,583.71 | 0.00 | 0.00 | 0.00 | 0.00 | 147.63 | 25 | |

| NGXBNK | 1,092.81 | -1.16 | -0.18 | 6.71 | 18.07 | 22.21 | 3,210 | |

| NGXCG | 2,813.17 | -0.73 | 0.86 | 7.50 | 18.76 | 26.86 | 6,648 | |

| NGXCNSMRGDS | 1,706.62 | 0.15 | 0.64 | 6.65 | 7.96 | 51.65 | 1,308 | |

| NGXGROWTH | 6,532.93 | 0.63 | 0.63 | 5.79 | 26.64 | 11.19 | 59 | |

| NGXINDUSTR | 3,565.69 | 0.01 | 0.15 | 0.22 | -6.35 | 28.71 | 546 | |

| NGXINS | 667.88 | 2.31 | 3.83 | 34.02 | 53.86 | 105.70 | 964 | |

| NGXLOTUSISLM | 6,770.89 | 0.09 | 1.21 | 8.74 | 11.38 | 44.74 | 1,777 | |

| NGXMAINBOARD | 4,944.30 | 0.09 | 0.30 | 4.25 | 2.47 | 39.23 | 8,284 | |

| NGXMERIGRW | 6,473.80 | -1.17 | -0.05 | 6.17 | 21.60 | 40.73 | 1,631 | |

| NGXMERIVAL | 10,419.21 | 0.16 | 0.79 | 7.68 | 34.29 | 97.24 | 3,385 | |

| NGXOILGAS | 2,709.99 | -0.21 | -0.07 | 13.39 | 36.29 | 158.87 | 536 | |

| NGXPENBRD | 1,810.59 | -0.11 | 0.76 | 3.77 | 5.83 | 36.11 | 9,787 | |

| NGXPENSION | 4,507.04 | -0.44 | 0.55 | 5.37 | 13.37 | 37.33 | 7,269 | |

| NGXPREMIUM | 9,673.53 | -0.32 | 1.68 | 4.99 | 7.64 | 33.52 | 3,532 | |

| NGXSOVBND | 621.97 | 0.00 | 0.00 | -0.12 | -0.37 | -18.13 | 0 |

For more detailed analysis,

- On InfoWARE Market Data Terminal <MKTINS> <GO>

- On InfoWARE Finance Mobile App ( Android, iPhone & iPad and Windows 10) , "Market Indexes"

Find the topic interesting? Will like to comment? Contact Us at solutions@infowarelimited.com

Top News

Market Summary 27-12-2024

MARKET PERFORMANCE REPORT & DAILY PRICE LIST

Chart Of The Day - ASI Chart Vs ASI Advance Decline Line (YTD) (27-Dec-2024 15:10:28.113)

InfoWARE Analyst Daily Market Report (27-Dec-2024 15:10:21.950)

[TANTALIZER]>>Corporate Disclosures-<TANTALIZERS PLC>

[XNSA]>> NORRENBERGER MUTUAL FUNDS WEEKLY UPDATE

[XNSA]>> DAILY FUND PRICE SUBMISSION - FCMB ASSET MANAGEMENT LIMITED

[XNSA]>> OFF MARKET TRADE

[XNSA]>> EMERGING AFRICA DAILY MUTUAL FUND PRICES

[MERGROWTH]>> DAILY INDICATIVE PRICES

[VETGOODS]>> DAILY INDICATIVE PRICES

[XNSA]>> NGX FIXED INCOME INDICATIVE PRICE LIST FOR DEC 27, 2024

[XNSA]>> CORDROS MILESTONE FUNDS' BID & OFFER PRICES

Chart Of The Day - ASI Chart Vs ASI Advance Decline Line (YTD) (24-Dec-2024 15:08:08.291)

InfoWARE Analyst Daily Market Report (24-Dec-2024 15:08:03.728)

[MERGROWTH]>> DAILY INDICATIVE PRICES

[LOTUSHAL15]>> DAILY INDICATIVE PRICES

[VETBANK]>> DAILY INDICATIVE PRICES

CSL Nigeria Daily - 24 December 2024

Media Highlights 24-12-2024

CardinalStone Company Update - AIRTEL AFRICA Plc - Operational strategies to support margins

[XNSA]>> NGX FIXED INCOME INDICATIVE PRICE LIST FOR DEC 24, 2024

[XNSA]>> CORDROS MILESTONE FUNDS' BID & OFFER PRICES

[XNSA]>> FBN HOLDINGS PLC: TRADING IN THE RIGHTS ISSUE

[VITAFOAM]>>Corporate Disclosures-<VITAFOAM NIG PLC.>

[XNSA]>> OFF MARKET TRADE

[XNSA]>> NOTICE OF EARLY MARKET CLOSURE

[XNSA]>> UNITED BANK FOR AFRICA PLC: ACTIVATION OF CODE FOR TRADING IN RIGHTS

[NASCON]>>Corporate Disclosures-<NASCON Allied Industries Plc>

[PZ]>>Corporate Disclosures-<P Z CUSSONS NIGERIA PLC.>